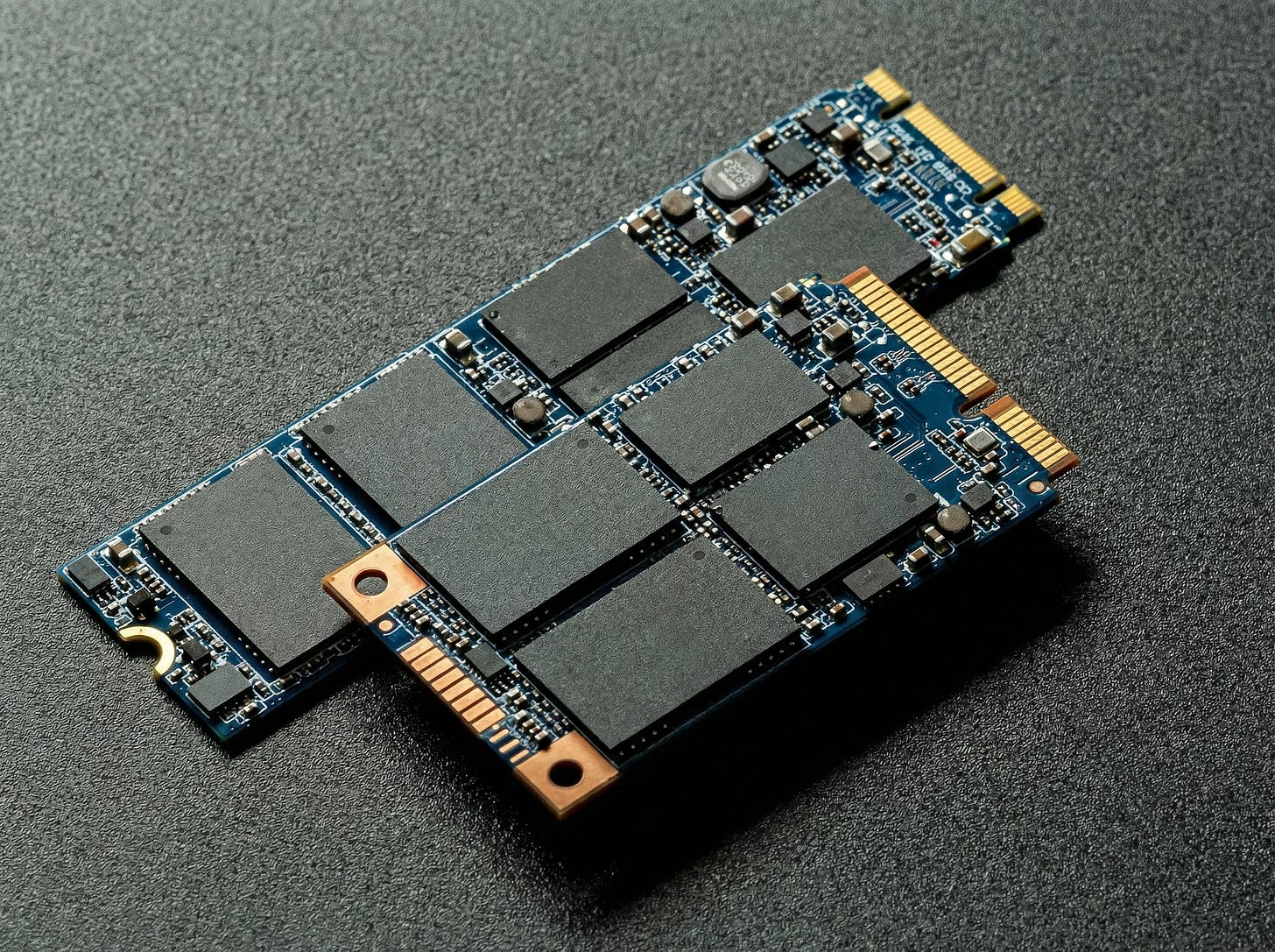

AI Gobbling Up NAND Means No More Cheap SSDs: Gamers, Your Storage Upgrades Just Got Pricier!

A senior executive at Kioxia, a major NAND flash producer, has warned that affordable 1TB SSDs are history, with the company’s entire 2026 production already sold out and shortages likely persisting into 2027 amid explosive demand from AI data centers.

Here’s the TL;DR...

Kioxia exec declares end to cheap storage: Shunsuke Nakato said production for 2026 is fully booked, blaming AI for driving up NAND demand and prices.

Price hikes already hitting shelves: Popular 1TB SSDs like the Samsung 990 Pro have jumped 83% in recent months, from $109.99 to $199.99.

Gamers feel the pinch: Larger game installs and next-gen consoles could mean pricier PC builds and upgrades through at least 2027.

Broader tech impact: AI servers are consuming massive NAND supplies, leading to shortages that affect PCs, smartphones, and enterprise storage.

Advice for buyers: Stock up on SSDs now if you’re planning a build, as analysts predict ongoing increases with no quick relief in sight.

Why are SSD prices skyrocketing in 2026?

Shunsuke Nakato, managing director of Kioxia’s memory business unit, laid it out plainly during a January 20, 2026, meeting in Seoul. He told reporters that his company’s NAND output for the year is completely spoken for. Production lines can’t ramp up fast enough to meet the flood of orders.

The culprit is clear: AI infrastructure. Data centers building out massive server farms for machine learning need enormous amounts of high-capacity storage. Kioxia, which supplies NAND to SSD makers like Samsung and Western Digital, is prioritizing these high-margin clients.

What did the Kioxia executive actually say about cheap 1TB SSDs?

In his comments at the Nine Tree Premier Locus Hotel in Yongsan-gu, Seoul, Nakato didn’t mince words.

“To be honest, this year’s production volume is already sold out. The days of cheap 1TB SSDs for around 7,000 yen (approximately $45) are over.”

He emphasized that delivery schedules and volumes are locked in through long-term agreements with partners.

“It’s physically impossible to arbitrarily accelerate delivery or increase volume simply because orders are piling up.”

These remarks were reported by Korean outlet Digital Daily.

How has AI demand already affected SSD prices?

Price tracking shows the pain is real. Between November 2025 and January 2026:

Corsair MP700 Pro XT 1TB rose 38%, from $159.99 to $219.99

Samsung 990 Pro 1TB climbed 83%, from $109.99 to $199.99

Western Digital SN700 1TB jumped 132%, from $129.99 to $299.99

Samsung 870 Evo 1TB (SATA) increased 51%, from $99.99 to $149.99

Analysts at TrendForce predict NAND flash prices will rise another 33–38% in early 2026 alone.

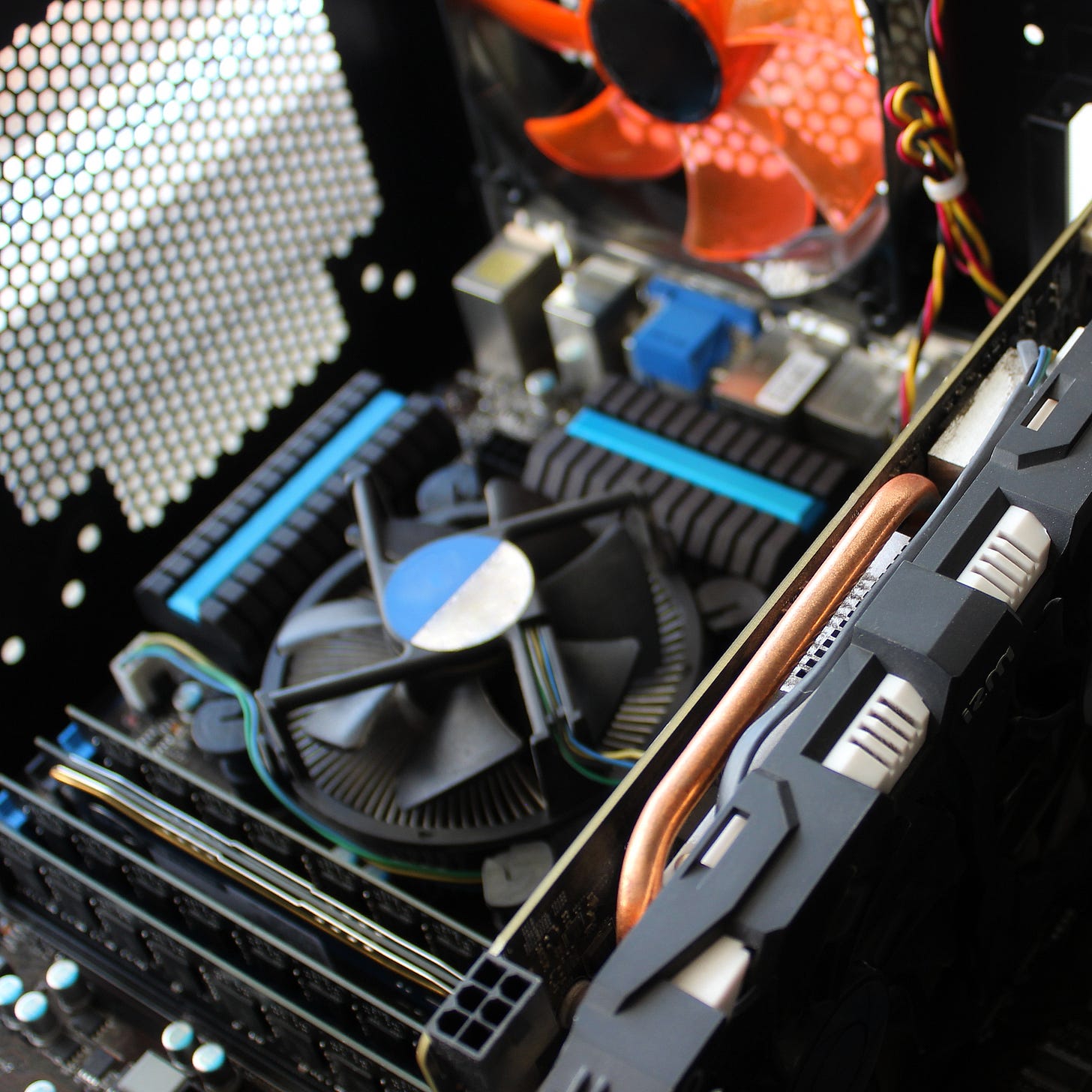

What does rising SSD prices mean for PC gamers?

For gamers, this spells trouble on multiple fronts. Modern titles like Cyberpunk 2077 with ray tracing packs or Starfield already demand 100GB-plus installs. A pricier 1TB or 2TB SSD stretches budgets further for fast load times and open-world streaming.

PC builders eyeing Ryzen 9000 or Intel Arrow Lake CPUs could see total system costs climb 15–20% if SSD and RAM increases compound. Console gamers may also feel it, with rumors suggesting the PlayStation 6 could lean even harder on SSD performance.

Are other memory components like RAM also impacted by AI?

Yes. The AI boom is squeezing DRAM just as hard. Micron, Samsung, and SK Hynix have shifted capacity toward high-bandwidth memory (HBM) for AI accelerators.

DRAM prices are forecast to surge 50–55% in Q1 2026. IDC analysts warn the crunch could slow smartphone and PC growth, with OEMs like Dell and Lenovo already flagging 15–20% price hikes.

How long will SSD shortages and price increases last?

Kioxia expects constraints through at least 2027. Even with expansions at its Yokkaichi and Kitakami fabs—using AI and IoT systems crunching 50TB of data per day—supply won’t catch up quickly.

Industry forecasts align. Citi estimates Nvidia’s Vera Rubin AI systems alone could consume 9.3% of global NAND by 2027, with relief unlikely until new fabs come online around 2028.

Is there any good news for budget-conscious gamers?

Not much, but timing matters. Buying SSDs now—before the next wave of increases—could save money. Enterprise SSDs have already jumped as much as 257% for some 30TB models, suggesting consumer drives may follow.

Hybrid setups using HDDs for bulk storage and SSDs for active games can help stretch budgets, but pure SSD builds will remain premium.

Could this SSD crisis affect next-gen gaming hardware?

Possibly. The Xbox Series X and PlayStation 5 already depend on fast SSDs for core features. Prolonged NAND shortages could lead to higher console prices or smaller base storage in future revisions.

On PC, GPU prices may rise too, as AI workloads divert silicon and memory resources. Nvidia’s Blackwell lineup has already faced delays tied partly to memory bottlenecks.

What steps are NAND makers taking to address the shortage?

Kioxia is prioritizing long-term partner agreements and ramping BiCS8 flash production. Competitors like Micron and SK Hynix are investing billions in new fabs and AI packaging facilities—but meaningful supply relief remains years away.

The AI-driven NAND crunch marks a major shift in tech priorities, with data centers outbidding consumers for memory. For gamers, the takeaway is simple: plan ahead, buy early, and expect higher storage costs through 2027.

Hat Tips

Tom’s Hardware, “Kioxia exec says the AI boom means the era of the cheap 1TB SSD is over,” January 21, 2026

PCGuide, “SSD exec claims the days of cheap 1TB SSDs are over,” January 2026

Digital Daily, Interview with Shunsuke Nakato, January 20, 2026

IDC, “Global Memory Shortage Crisis,” January 2026

Forbes, “As AI Eats Up The World’s Chips, Memory Prices Take The Hit,” January 16, 2026

CNBC, “Micron AI memory shortage,” January 10, 2026

Windows Central, “AI-driven RAM shortages threaten the PC market,” January 2026

Article Compiled and Edited by Derek Gibbs on January 21, 2026 for Clownfish TV D/REZZED.

The part about long-term agreements locking inproduction really explains why prices can't just normalize quickly. People keep saying "supply will catch up" but when manufacturers are contractually bound to data center clients through 2027, the consumer market basically has to wait in line. The 83% jump on the 990 Pro is wild, esp when it's not even driven by component shortages but demand reallocation.