Someone Paid $3 Million for an NFT of the Very First Tweet. It’s Worth $0 Now.

The NFT of Jack Dorsey’s first tweet, which fetched nearly $3 million at auction in 2021, now carries a negligible value amid the volatile cryptocurrency landscape, highlighting the risks tied to digital collectibles.

Here’s the TL;DR...

Initial Sale Details: Twitter co-founder Jack Dorsey sold the NFT of his March 2006 tweet for $2.9 million to Malaysian-Iranian entrepreneur Sina Estavi.

Resale Attempts: Estavi listed it for $48 million in 2022, but the highest bid reached only $280, far below expectations.

Value Decline: By mid-2023, market assessments pegged the NFT’s worth at under $4, reflecting a broader downturn in the sector.

Current Status in 2026: Recent social media discussions estimate its value at around $10, though no active listings confirm ongoing bids.

Market Context: The NFT space shows early signs of recovery in 2026, with projections for growth driven by new trends like AI integration and real-world asset tokenization.

What Was Jack Dorsey’s First Tweet, and Why Did It Become an NFT?

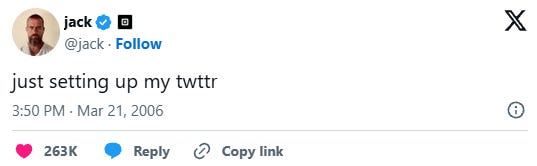

Jack Dorsey posted his first tweet on March 21, 2006, simply stating: “just setting up my twttr.” This message marked the birth of Twitter, now known as X.

Dorsey tokenized it as an NFT in 2021 through the platform Valuables by Cent, turning the digital artifact into a unique blockchain asset.

The sale tapped into the NFT boom, where collectors sought ownership of historical internet moments.

Who Bought the NFT of Jack Dorsey’s First Tweet?

Sina Estavi, a crypto entrepreneur and CEO of Bridge Oracle, acquired the NFT for 1,630.58 ETH, equivalent to $2.915 million at the time.

Estavi outbid others, including Tron founder Justin Sun, in a competitive auction.

He viewed the purchase as an investment in digital history, later stating on Twitter that the tweet would be “worth more” in the future.

How Much Did Jack Dorsey Donate From the NFT Sale?

Dorsey converted the proceeds to Bitcoin and donated the full amount to GiveDirectly, a nonprofit focused on cash transfers in Africa.

The donation supported the organization’s Africa Response fund, aiding poverty alleviation efforts.

GiveDirectly confirmed receipt of the funds, which totaled about 7 BTC after conversion.

What Happened When Sina Estavi Tried to Resell the NFT?

In April 2022, Estavi listed the NFT on OpenSea with a starting price of $48 million, pledging to donate half the proceeds to charity.

Bids trickled in slowly, peaking at just 0.09 ETH, or around $280.

Estavi rejected the offers, insisting on a minimum of $50 million, and removed the listing after the auction ended without a sale.

Why Did the Value of Jack Dorsey’s First Tweet NFT Drop So Dramatically?

The decline mirrored the overall NFT market crash post-2021 hype, where trading volumes fell by over 90% by late 2022.

Speculative fervor gave way to skepticism as economic factors, including rising interest rates, pulled investors toward safer assets.

Critics pointed to NFTs’ reliance on perceived scarcity, which proved fragile without sustained demand.

What Is Sina Estavi’s Background and Recent Developments?

Estavi built his profile in the crypto space through Bridge Oracle, a platform linking blockchains to external data.

He faced legal troubles in Iran, arrested in May 2021 on charges related to disrupting the economic system via cryptocurrency activities.

By 2025, Iranian courts sentenced him to 15 years in prison for fraud, though he reportedly fled the country amid ongoing investigations.

How Has the NFT Market Evolved Since the 2021 Boom?

After peaking at billions in monthly sales, the market contracted sharply through 2023 and 2024, with many projects losing 99% of their value.

Utility-focused NFTs gained traction, shifting from art to applications in gaming and intellectual property.

By 2025, Ethereum remained dominant, but competitors like Solana captured shares with lower fees.

What Are the Current Trends in the NFT Market as of 2026?

Early 2026 data shows rebounding transaction volumes, up from late-2025 lows, fueled by institutional interest.

Key trends include tokenizing real-world assets like real estate, AI-generated dynamic NFTs, and multi-chain interoperability for broader access.

Projections estimate the global NFT market reaching $86 billion in value by year-end, driven by creator economies and blockchain advancements.

Are There Other Famous NFTs That Lost Significant Value?

Yes, several high-profile cases echo this story.

A CryptoPunk NFT bought for $1 million in 2021 sold for $139,000 six months later amid market cooling.

Bored Ape Yacht Club tokens, once valued in the millions, saw floor prices drop by 80% or more during the bear market.

These examples underscore the sector’s volatility, where hype often outpaces fundamentals.

What Lessons Can Investors Learn From the First Tweet NFT Saga?

Diversification remains key in crypto investments, as single-asset bets carry high risk.

Understanding underlying technology and market cycles helps avoid chasing trends.

Regulatory clarity, expected to improve by late 2026, could stabilize values but won’t eliminate speculation’s downsides.

Could the First Tweet NFT Regain Value in the Future?

Recovery isn’t impossible, given the NFT market’s nascent rebound.

If historical significance draws renewed interest or if X integrates NFTs, demand might spike.

However, without active promotion, it risks remaining a cautionary tale of digital asset bubbles.

Hat Tips

Forbes, Why Jack Dorsey’s First-Tweet NFT Plummeted 99% In Value In A Year, April 14, 2022

CNBC, Jack Dorsey sells his first tweet ever as an NFT for over $2.9 million, March 22, 2021 https://www.cnbc.com/2021/03/22/jack-dorsey-sells-his-first-tweet-ever-as-an-nft-for-over-2point9-million.html

CoinDesk, ‘Jack Dorsey’s First Tweet’ NFT Went on Sale for $48M. It Ended With a Top Bid of Just $280, April 13, 2022 https://www.coindesk.com/business/2022/04/13/jack-dorseys-first-tweet-nft-went-on-sale-for-48m-it-ended-with-a-top-bid-of-just-280

BBC, Jack Dorsey’s first ever tweet sells for $2.9m, March 22, 2021 https://www.bbc.com/news/business-56492358

CryptoSlate, NFT of Jack Dorsey’s first tweet, originally purchased for $2.9M, is worth less than $4 in today’s market, July 20, 2023 https://cryptoslate.com/the-nft-of-jack-dorseys-first-tweet-originally-purchased-for-2-9m-is-worth-less-than-4-in-todays-market

Entrepreneur, The First-Ever Tweet in NFT Format Sold for $2.9 Million in March 2021. The Most Recent Bid Is $132., October 17, 2022 https://www.entrepreneur.com/news-and-trends/once-worth-29-million-nft-of-first-ever-tweet-is-now-132/437349

Reuters, Bought for $2.9 mln, NFT of Jack Dorsey tweet finds few takers, April 14, 2022 https://www.reuters.com/technology/bought-29-mln-nft-jack-dorsey-tweet-finds-few-takers-2022-04-14

Bankless, 6 NFT Predictions for 2026, January 6, 2026 https://www.bankless.com/read/2026-nft-predictions

The Business Research Company, Non-Fungible Token Market Size and Share Report 2026 https://www.thebusinessresearchcompany.com/report/non-fungible-token-global-market-report

The Block, 2026 NFTs & Gaming Outlook, December 31, 2025 https://www.theblock.co/post/382794/2026-nfts-gaming-outlook

Iran International, IRGC agents stole millions during crypto fraud case, leaked files reveal, March 30, 2025 https://www.iranintl.com/en/202503309549

Fortune, Death of the NFT? CryptoPunk bought for $1 million sells for $139,000 just 6 months later, May 9, 2022 https://fortune.com/2022/05/09/death-of-cryptopunk-nft-bayc-bored-apes-yuga-larva

Forbes, 3 Crypto Trends Set To Dominate 2026, January 1, 2026 https://www.forbes.com/sites/digital-assets/2026/01/01/3-crypto-trends-set-to-dominate-2026

Article Compiled and Edited by Derek Gibbs on January 25, 2026 for Clownfish TV D/REZZED

The Estavi resale attempt really captures the whole cycle perfectly. Someone buys during peak hype expecting value to compound,then reality sets in that scarcity alone doesn't create worth. I remember watching similar patterns with early collectible markets where provenance mattered way less than people thought once the initial buzz faded. The $48M asking vs $280 bid gap is brutal.